Cryptocurrency enthusiast or curious about the Bitcoin market? If you’re asking the question “is Bitcoin expected to go back up?” you’ve come to the right place. In this blog, we’ll explore all the latest news and insights in the world of Bitcoin trading, so you can make informed decisions on your investment strategies. Let’s dive in!

Factors that Influence Bitcoin Prices

Bitcoin prices have experienced great volatility since it was created in 2009. While some investors have made a great return from the digital currency, not everyone has had the same experience. Knowing the factors that influence its prices can help traders make informed decisions about when to buy and sell their Bitcoin holdings on sites like thequantumai.app.

The most influential factor driving Bitcoin prices is speculation among traders and investors, particularly in news headlines regarding government regulation surrounding cryptocurrencies. Other major factors that can affect cryptocurrency prices are changes in technology related to Bitcoin, its perceived value as an investment opportunity (or lack thereof), and developments affecting its usability as a form of payment.

Supply and demand is one of the primary forces influencing Bitcoin price movements. When an investment opportunity presents itself, more people become interested in buying it and thus drive up demand while pushing the price higher. When demand starts to drop, so does the price of an asset – regardless of its type – when supply exceeds demand.

In some cases, speculation of negative news or events like hard forks or technological challenges can also cause a decrease in demand for cryptocurrency assets, leading to a sharp fall in price as supply outstrips demand again. Institutional investors also play a role; government regulations or concerns about certain use cases could influence their decision on whether or not to invest into any given digital asset at certain times, swaying both supply and demand for them across different markets and exchanges.

Analyzing Current Bitcoin Market Trends

The main drivers of this market prices are supply and demand, news events such as government regulations, and economic trends like inflation or deflation. By monitoring these variables and staying up-to-date on changing market conditions, traders can gain insight into which direction the price may go in the future.

An additional factor in determining its performance is investment activity by major institutions. Warren Buffett’s Berkshire Hathaway recently announced investments into Bitcoin-related businesses, indicating confidence in the crypto currency’s long-term potential for success. This could provide some assurance for traders considering putting their money into Bitcoin even if short-term price movements are uncertain.

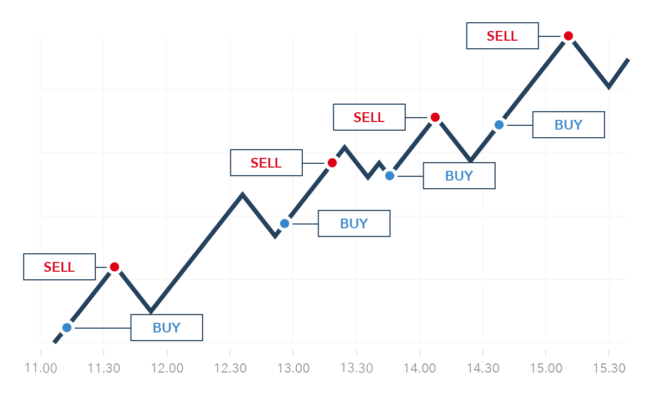

Traders should also consider studying technical analysis to interpret changes in historical data and spot patterns to use as a basis for trading decisions. This requires reviewing charts detailing a wide range of metrics such as moving averages, relative strength index (RSI), volume analysis and other indicators that can provide clues to help forecast future events more accurately. By researching information on these topics, traders can develop an understanding of historical trends so they can make better decisions when entering or exiting positions on the market.

Predictions for Bitcoin’s Future Performance

In general, most experts agree that this crypto value should increase over time because of its widespread acceptance as a legitimate form of payment and the limited supply of coins. This means that there could be opportunities for immense growth in the coming years. As cryptocurrency trading apps becomes more mainstream, some investors are now taking advantage of financial instruments such as futures contracts to hedge against risk associated with this emerging asset class.

On the other hand, concerns about Bitcoin’s scaling issues – which limit how quickly transactions can be processed – as well as increasing regulation and speculation could lead to decreased investor confidence in the cryptocurrency. These factors could potentially create a major bear market or price crash in the future.

Investors should carefully consider news updates related to it before making decisions about their investments. It is important to remember that investing in speculative digital assets like cryptocurrency carries significant risk; therefore individuals should always proceed with caution when investing in any digital currency or token-based system.

Strategies for Trading Bitcoin

One important strategy for trading it is choosing a good entry point. It’s important to look for days where the cryptocurrency drops in value, as this could represent an opportunity to buy low. Like all asset classes, it can be volatile, so it’s wise for traders to keep up with news and economic forecasts that could influence its price action.

Another strategy is setting a stop-loss order when going long on it. A stop-loss order automatically liquidates a position if it moves too far against you, protecting you from further losses and providing peace of mind. Of course, once Bitcoin reaches your price target or stops going up in value, you should also consider taking profits before the market reverses direction.

Finally, experienced traders should consider hedging their positions by diversifying their portfolio across several asset classes such as stocks or bonds; this helps balance out risk over different markets while also spreading out potential gains more evenly. Ultimately choosing how to trade bitcoin depends on an individual’s risk appetite and overall financial situation – but these strategies can help ensure good results as you enter the cryptocurrency market!

Conclusion

What can traders expect from Bitcoin in the short to medium term? Analysts are divided on whether Bitcoin will continue to rise or fall in value. Still, most agree that there is strong evidence that Bitcoin has already cemented itself as a safe haven asset with huge potential for profits if traded correctly.

However, due to its considerable volatility and ever-changing news cycle surrounding the crypto markets, it is important for traders to keep up-to-date with developing news and trends before placing their trades. It is also essential to do your own research on a particular trading strategy or coin before investing money into it with the aim of seeking rewards.

Ultimately, whatever path one chooses for trading Bitcoin – researching fundamentals or using technical analysis – being knowledgeable about the current market and how different strategies can impact your trades will help improve your success when it comes to trading cryptocurrencies like Bitcoin.