Cryptocurrency and blockchain are two terms that you may encounter when it comes to crypto trading. Check out this guide to learn about cryptocurrency and the blockchain, their history, and how they work.

History Of Cryptocurrency And Blockchain

Cryptocurrencies have a long history; in the 1980s, they were known as “cyber currencies.” David Chaum is a well-known cryptographer and posted a seminar paper explaining an early type of unidentified cryptographic electronic money in 1983, when the concept of cryptocurrencies first came to light.

2009 saw the creation of Bitcoin, which is the first ever cryptocurrency to be created. Even at the beginning of 2010, Bitcoin was the only crypto coin available. After Litecoin’s creation in late 2010, many more cryptocurrencies entered the market during the following ten years. As of July 2024, there are over 20,000 cryptocurrencies in circulation.

In addition to that, since 2024, about 1000 new currencies are launched every month. However, you have to remember that not all the launched cryptocurrencies are performing well since a few virtual currencies fail within a few months.

The foremost description of a cryptographically protected line of blocks was made in 1991 by Stuart Haber and W Scott Stornetta. Nick Szabo developed “bit gold,” which is decentralized virtual money, in 1998. Stefan Konst released his thesis on cryptographically protected chains along with suggestions for application in 2000. In a white paper published in 2008, Satoshi Nakamoto laid out the framework for a blockchain.

Satoshi Nakamoto established the first blockchain as the public log for bitcoin transactions in 2009. Nakamoto utilized a technique similar to Hashcash as the architecture continued to advance and change. It ultimately evolved into the core of bitcoin and acts as a public record for all network transfers. The Bitcoin blockchain file stores all payments and documents on the network, and it proceeds to thrive gradually. In 2014, it achieved 20 gigabytes and finally surpassed 200 gigabytes in 2020.

Explaining Cryptocurrency

The digital currency known as cryptocurrency is decentralized and relies on blockchain technology, and is encrypted. In other words, it is a virtual payment network that does not depend on financial institutions to confirm transactions. Peer-to-peer technology makes it possible for anybody, anywhere, to make and get payments.

Cryptocurrency payments are entirely virtual, which attracts many individuals. A public register keeps track of all transactions that involve money transfers. The virtual coins are stored in digital wallets, either offline or online wallets.

Sophisticated coding is required to store and dispatch crypto data between wallets and registers, which uses encryption to verify transactions. Encryption’s goal is to offer security and protection. To begin trading cryptocurrencies, make sure to go to BitcoinMotion and register for an account.

Cryptocurrencies are created through a procedure known as “mining,” which is entirely digital. This procedure is intricate. In essence, miners get paid with crypto coins in exchange for using specialized computer systems to decipher specific mathematical riddles.

Explaining Blockchain Technology

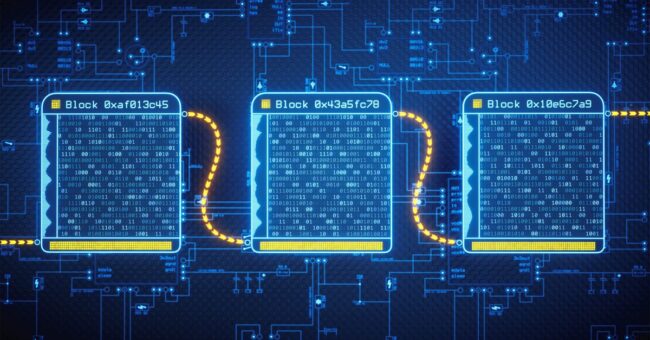

Some people refer to blockchain as distributed ledger technology (DLT). The usage of decentralization and cryptographic hash ensures that the past of any digital asset is both unchangeable and clear. It is a technique for storing data that renders the system tricky or impossible to alter, hack, or manipulate. A blockchain is a type of distributed register that spreads out and copies transactions among the network of computers involved.

It is a peer-to-peer network’s decentralized catalog of all transfers. Users can confirm transactions with this technology without the requirement for a prominent clearance organization. Applications might involve paying bills, concluding business deals, casting ballots, and a host of other things. Blockchain collections are public and created with intrinsic safety criteria, which makes it a high-end technology for nearly all fields.

Blockchain technology is a framework for storing public transactional records, also known as blocks, across several databases. These databases, which are referred to as the “chain,” are protected by a network of peer-to-peer nodes. This type of storage is frequently overseen as a “digital ledger.” All transfers in this ledger are validated and protected against fraud by the owner’s digital signature, which also serves to authenticate the transaction. As a result, the data in the digital register is quite safe.

Currently, banks, insurance, and other corporate sectors employ blockchain technology. The market for cryptocurrencies is projected to expand at an annual growth speed of 12.8% from 2024 to surpass $4.94 billion by 2030. It has become possible as there is a high demand to enhance the present payment procedures, upgrade in multinational payments, and boost in the requirements to keep the data safe.

Explaining How Does Blockchain Work

Blocks, nodes, and miners are three crucial aspects of the blockchain. Every block in a chain is made up of three fundamental building blocks (data, nonce, and hash). The cryptographic hash is produced by a nonce at the beginning of a chain. Mining is the procedure by which miners add new blocks to the chain.

Every payment is documented as a “block” of data as it happens. These transactions demonstrate the transfer of an investment, which may be tangible or intangible. The blocks that come before and after each other are attached. As an asset is shifted from one location to another or ownership shifts, these blocks create a chain of data.

The blocks attach safely together to deter blocks from being modified or a block from being introduced between existing ones. In addition, the blocks certify the precise timing and order of transactions. A blockchain is an irreversible chain in which transfers are blocked concurrently. Every new block reinforces the prior block’s verification and, by extension, the blockchain as a whole.

Once a block is mined, the modification is acknowledged by all of the network’s nodes, and the miner gets paid. It gives the blockchain the crucial strength of immutability and makes it tamper-resistant. By doing this, you and other network users may create a trusted ledger of transactions and eliminate the chance of tampering by malevolent actors.

Bottom Line

Investing in cryptocurrencies has become popular, and millions of people are trading crypto coins to gain profits within a short duration. Also, the usage of blockchain technology is not only limited to the crypto field as many sectors, including banking and insurance, rely on this modern technology.