We know the routine well, we work, wait for payday, and then spend it. We keep repeating this cycle and fail to realize that sometimes we get caught up in financial mistakes.

Living off a basic salary, and having a clear budget is needed to ensure that we don’t experience financial problems in the future. Some people may tend to override the importance of budgeting, which then results in them using their money for more than what they earn.

Moreover, with various needs that continue to increase and the threat of future recession that just looming around the horizon. This situation, if not accompanied by government help and increased salary can definitely cause financial problems. You need to carefully manage your monthly salary so you won’t be tempted to get yourself into debt, especially for secondary needs that are less important.

To ensure you can manage your income better, and prevent yourself from falling off the grid due to financial problems, keep on reading below to get the ultimate best-kept secret to manage your salary and finance better.

1. Understand Your Financial Situation

Understand your current financial situation and learn how to manage it in such a way, thus you can pay your bills on time and be prepared for future financial problems.

2. Address Your Financial Problems

If you notice that your salary can’t cover your needs properly, resulting in you keep counting the days until the next payday – you have to understand that this is a problem.

Acknowledge that there is something wrong with your financial situation, and thus there is a problem that needs to be addressed. This is the first step to making changes to your financial capabilities. To address your financial problem, you need to make a review of your spending, and check whether you spend more than you earn on non-essential things. If so, then this problem needs to be eliminated.

3. Check Bank Account Statements

As mentioned before, you need to review your spending from time to time. It is important to see what you are spending money on. To be able to make a financial review, you need to check your bank account statement. Find out how much you spend on groceries, entertainment, shopping, or monthly necessities. You may even find yourself paying for things you don’t even use anymore like subscriptions or gym memberships.

4. Stop Overspending

Until you understand what your current financial situation is, unplanned spending isn’t something you can afford to do. Even if there is money left in the account, this money may be needed to pay for less frequent expenses such as car registration, annual insurance, servicing, and tool replacements.

5. Have a Routine Spending Plan

Have a plan for routine weekly expenses, irregular expenses, and unexpected expenses in the future. Life is unpredictable so setting aside some money for possible job losses, illness, or family events, this will help make these difficult times less painful.

6. Use the 50-30-20 Method

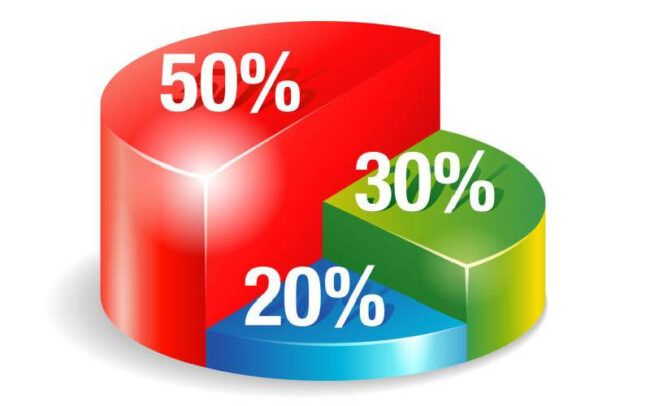

The 50-30-20 method is a powerful way to manage your monthly finances so you don’t waste money. One of the 100 most influential people in the world according to Times Magazine, Elizabeth Warren first popularized this method.

Often, people spend so much money that they forget to meet their basic needs. Inappropriate salary allocations can make it difficult for people to manage finances. For that, you have to choose a suitable way of managing finances. Managing income with the 50-30-20 method is easy for everyone from all walks of life. Starting from people with high income to people with minimal salary. Therefore, this method can be an alternative in financial planning.

Simply put, this 50-30-20 method will allocate 50% of your income for basic needs, 30% for fulfilling personal desires, and another 20% set aside for savings.

● Allocate 50% of Salary for Basic Needs

Most of your income must meet your basic daily needs. For that, you have to allocate 50% of your income to buy groceries, toiletries, electricity costs, phone credit, medicines, transportation costs, insurance, and many other of your basic needs. Make sure you calculate 50% of your net income every month. To be more optimal, you can make a list of expenses every month so you don’t experience overspending.

● Allocate 30% of Salary for Self-Reward

It is okay for you to allocate 30% of your salary for entertainment needs or things that you want. For example, subscribing to movie streaming services, traveling, staycation, shopping, and so on. Everyone needs self-reward too, right? Thus, you can allocate 30% of your income to fulfill your desires as a form of self-reward! This category includes secondary or tertiary expenses other than basic needs every month.

To ensure you can get the most out of your self-reward, you can now shop at Temu, a new shopping platform that offers a variety of products at a very affordable price! Even with just a little budget, you can get the most out of it optimally only at Temu!

● Allocate 20% of Salary for Savings and Investments

Savings and investment activities are important parts of managing finances. To save for an emergency fund, you can allocate it to another bank account so you can prepare funds for any unexpected situations. Besides saving, investing can optimize your income to prepare for future financial goals. For example, you want to prepare for marriage expenses, buying a house, buying a vehicle, retirement fund, and so on.

7. Have Two Different Bank Accounts

In managing finances, it is important for you to have 2 accounts at different banks. You can use the first account to carry out all transaction activities such as paying bills, home installments, paying insurance and others. Meanwhile for the second account it functions as a savings account. Thus, you should hold yourself back to not withdraw money from this account unless it is really critical!

Hopefully, the thorough tips we have mentioned above can help to improve your financial situation. You can definitely improve your life, if you manage your finances properly. Good luck in trying!