Decentralized Finance, or DeFi for short, transforms how we manage money. With blockchain technology, it bypasses intermediaries such as banks, creating an open, accessible, and borderless financial system.

It’s an ecosystem where individuals can borrow, lend, exchange, and earn peer-to-peer interest without paperwork or centralized oversight. But what is DeFi in crypto, and why is it transforming finance? Let’s get inside.

Decentralized finance, also known as DeFi, can

Decentralized finance, abbreviated as DeFi, is a blockchain financial architecture wherein decentralized institutions replace traditional institutions. In contrast to conventional finance, or TradFi, in which banks regulate transactions, DeFi uses public ledgers such as Ethereum, allowing for trustless interactions among participants.

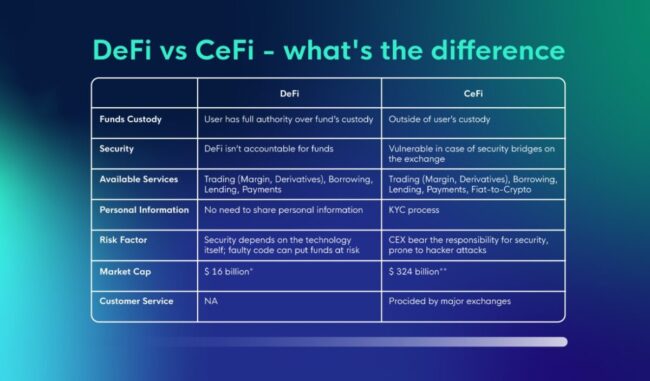

Some key differences among these include:

- No middlemen. Transactions happen directly among users through smart contracts.

- Global reach. Anyone connected to the internet can join in.

- Transparency. Transactions are recorded on an openly accessible public blockchain.

For instance, while banks can charge for loans and cross-border transfers, DeFi platforms such as Aave do so at a minute fraction of the expense. It also gives individuals complete control of assets, unlike in traditional systems where banks serve as custodial authorities.

How Does It Work?

The Technology Behind the Revolution

DeFi is dependent upon three fundamental technologies:

- Blockchain. A decentralized ledger of transactions across multiple computers. Ethereum is the largest DeFi blockchain, supporting over 80% of protocols.

- Smart contracts. Self-executing code for automating agreements. Compound utilizes smart contracts to coordinate loans without human interaction.

- dApps. Decentralized applications such as Uniswap or MakerDAO allow for accessible trading, lending, and staking interfaces.

By combining all these tools, DeFi facilitates peer-to-peer transfers without intermediaries. Imagine transferring funds across borders in seconds—no fees, no bank approval. For those who need to sell crypto quickly, xgram.io platforms seamlessly integrate into DeFi protocols, allowing for safe and fast transfers.

Key Components of the Ecosystem

The DeFi ecosystem rests upon four pillars:

- Decentralized exchanges (DEXs) allow for direct trades of cryptocurrencies without using centralized exchanges such as Coinbase.

- Lending/borrowing terms. Platforms such as Aave enable individuals to receive interest on deposits or borrow funds by offering crypto as collateral.

- Stablecoins. Stablecoins such as USDC or DAI keep a 1:1 ratio against the dollar, minimizing volatility in these trades.

- Yield farming. Users “stake” crypto in pools to earn rewards, although impermanent loss risks still apply.

These elements complement one another to form an independent financial system. For example, stablecoins offer traders at DEXs price stability, while yield farming encourages liquidity providers to aid those platforms.

The Benefits of DeFi ─ Why It’s Upheaving Finance

- Financial inclusion. 1.7+ billion unbanked adults have access to loans or savings through DeFi.

- Lower fees. Eliminating intermediaries saves money—sending 1M via Ethereum costs under $10.

- 24/7 Accessibleness. In contrast to banks, DeFi platforms never close.

- Transparency. All exchanges are traceable, minimizing fraud.

For instance, any farmer in Kenya can now get a loan based on crypto collateral, which is impossible with conventional banks. Additionally, freelancers across the globe use DeFi to get paid instantly without waiting for legacy banking systems.

Risks of DeFi ─ Approach With Caution

Though promising, DeFi is fraught with risks:

- Smart contract vulnerabilities. Code errors have caused hacks, such as the $600M Poly Network hack.

- Regulatory uncertainty. Governments continue to figure out how to regulate DeFi protocols.

- Scams have taken an estimated $2.8B out of investors’ pockets in 2023.

- Volatility. Cryptocurrency price fluctuations can wipe out collateralized loans overnight.

To limit these risks:

- Use platforms audited by professionals

- Diversify assets

- Hold assets in non-custodial wallets such as MetaMask

Stay informed through trusted DeFi analytics sites and community forums. Avoid unknown tokens with low liquidity. Regularly review smart contract audits and protocol updates to identify emerging vulnerabilities and potential exit scams.

The Future of DeFi ─ Challenges and Innovation to Come

Defi is constantly evolving, and its trends include:

- Institutional adoption. Large banks are investigating blockchain-based settlements.

- Cross-chain interoperability. Such protocols as Polkadot seek to interconnect different blockchains

- Regulatory frameworks. The EU MiCA legislation can unify DeFi compliance by 2026.

Scalability problems (e.g., Ethereum’s high gas fees) still need to be overcome for mass acceptance. Solutions like Ethereum 2.0 and Layer-2 (e.g., Optimism) seek to address those problems.

Adopting the DeFi Movement

DeFi is nothing short of a financial revolution—revolutionizing access, reducing fees, and enabling innovation. Although risks such as smart contract exploits remain, the future of a better financial system is inevitable. Whether you loan crypto on Aave or use xgram.io to sell crypto safely, knowledge of DeFi is essential to understanding the future of currency.

As space evolves, education and prudence will be paramount. Stay up-to-date, diversify your investments, and accept the decentralized future—one block at a time.

Why Does DeFi Matter to Non-Technical Individuals?

Decentralized finance isn’t only for tech geeks. It has practical advantages for regular consumers:

- Microloans. Get small loans without credit checks.

- Generating passive income. Stake stablecoins to earn a maximum of 10% APY.

- Censorship resistance. Nobody can lock you out.

Platforms such as xgram.io make selling crypto easier, filling the gap between decentralized and traditional finance. With friendly interfaces, DeFi is now within reach for mass consumers.

Real-world Applications of CeFi and DeFi

From remittances to insurance, DeFi is changing industries:

- Remittances. Laborers can send abroad at virtually zero fees by using stablecoins.

- Insurance. Decentralized platforms such as Nexus Mutual protect against failures in smart contracts.

- Prediction markets. Platforms such as Augur allow individuals to bet on real-life events without brokers.

These advances illustrate the possibilities for reimagining how we engage with money, contracts, and governance structures.

Final Thoughts ─ Navigating the Landscape

As DeFi evolves, it’s crucial to remain current about trends and vulnerabilities. Stay current on reputable news, participate in community forums, and test carefully in small quantities. The future of finance is decentralized—nearer than you know.